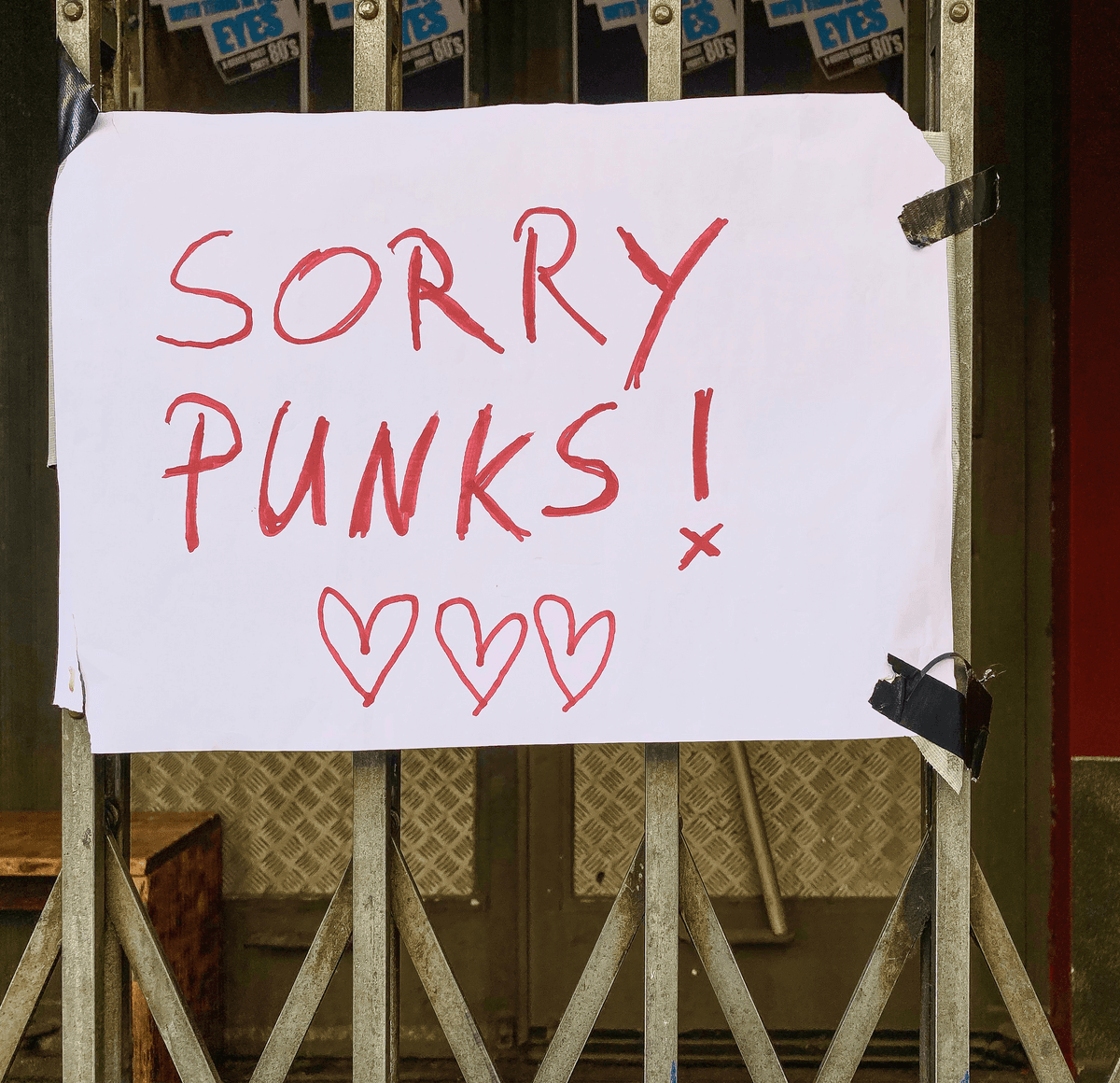

Get instant & affordable Event Cancellation cover

When does Event Cancellation insurance help?

Sometimes, circumstances beyond your control mean you have no choice but to cancel, delay, postpone, curtail, interrupt or abandon your event. Perhaps it’s too windy for your marquees to be used safely, or your keynote speaker has been delayed due to travel disruption. This can cost you quite a lot of money!

What will Event Cancellation insurance actually pay for?

Additional expenses (to prevent a full cancellation)

Costs & Expenses

Total Event Revenue (i.e. loss of profit)

Should I cover Gross Revenue or Costs & Expenses?

For a first time event, you will only be able to cover your Costs & Expenses (i.e no track record of profit!). For established events, the choice is yours as to whether you want to cover your profit or not!

Member of...

The issues we cover

Select your cover

Full cover or only the cover you needAdd event details

Quickly and easily enter your event infoInstant quote

Option to review with an expert free of chargeMake payment

We use stripe for instant secure payments